SIP Planning

Coming Soon! 🎉

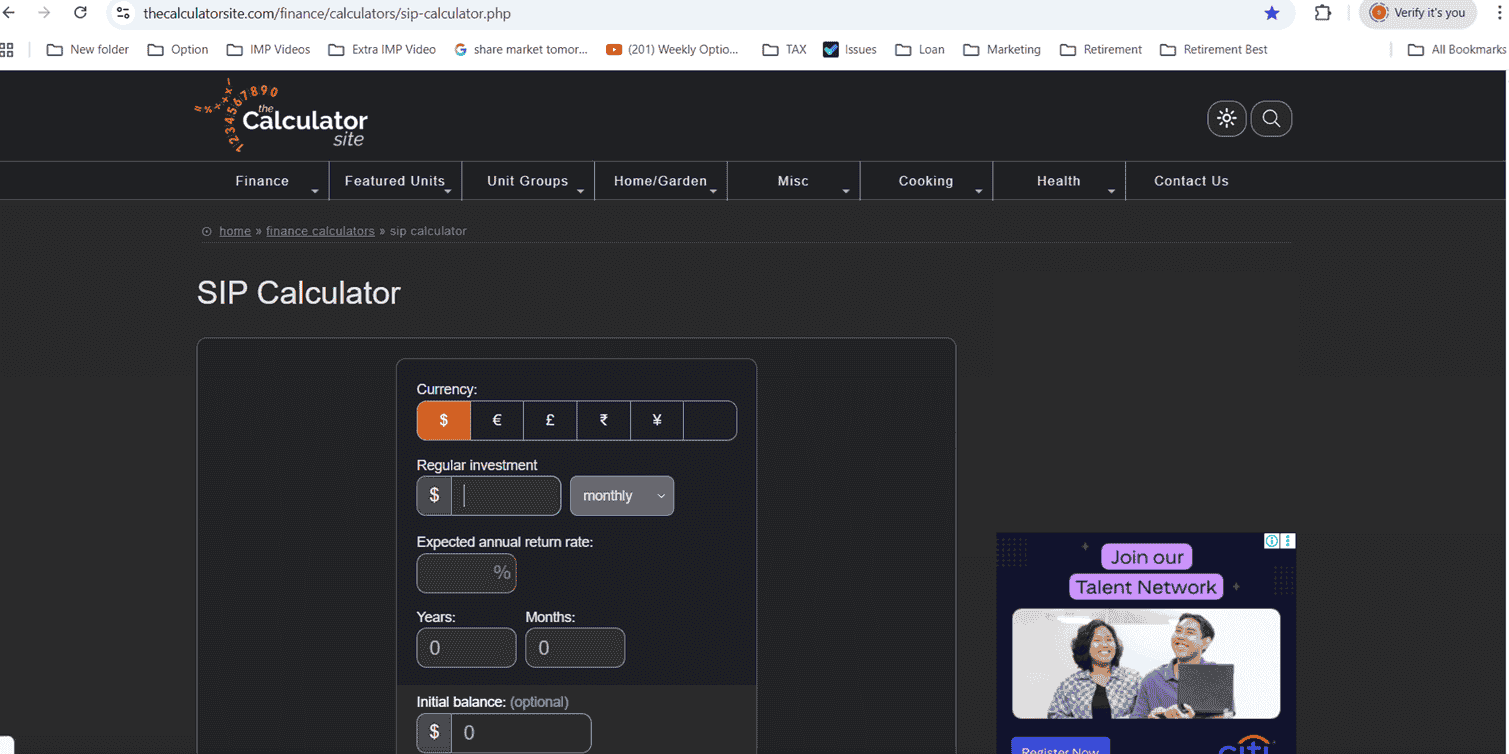

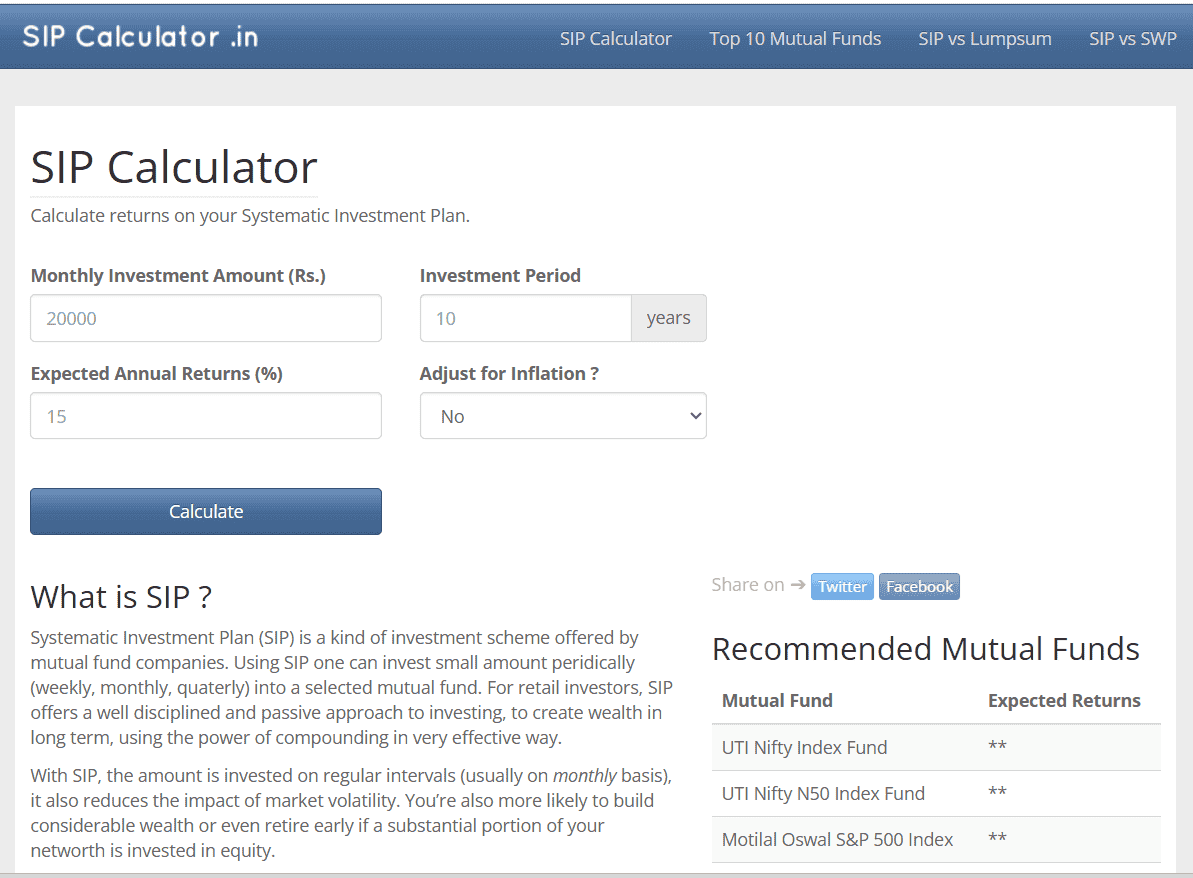

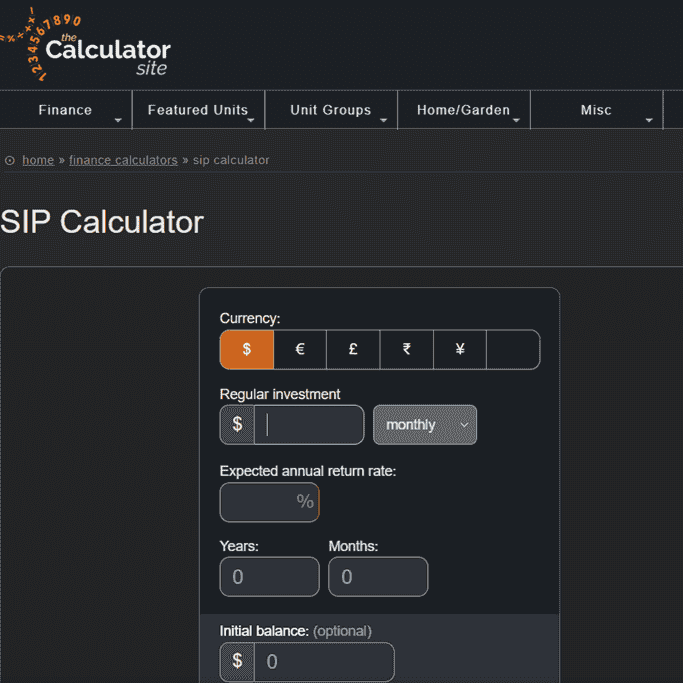

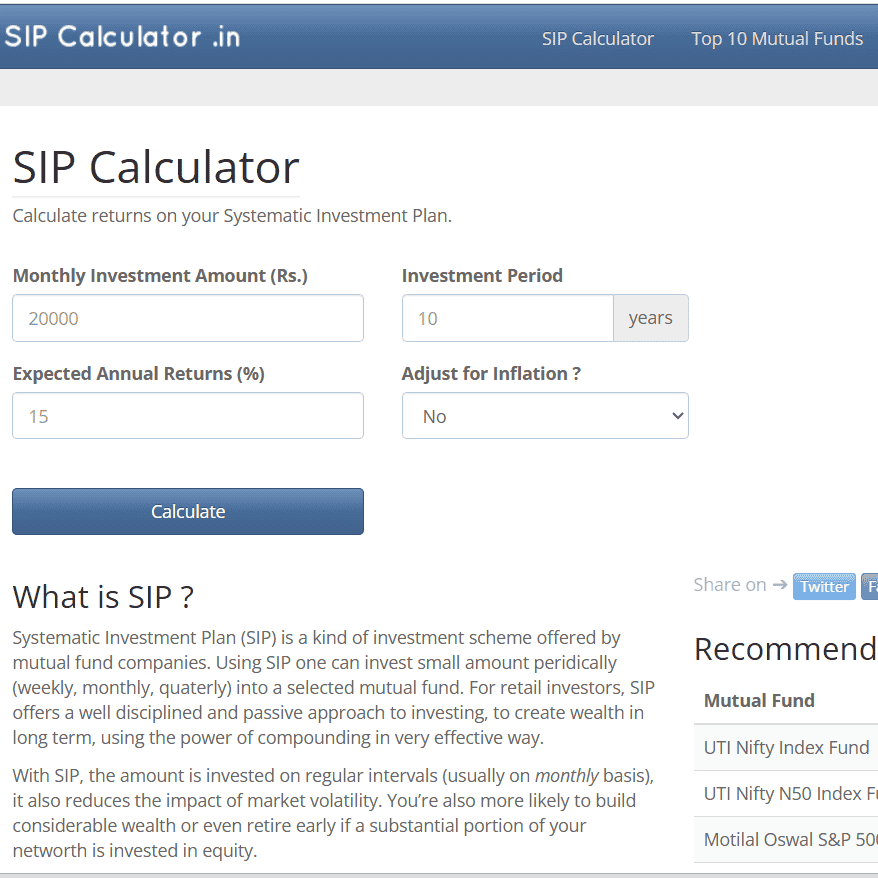

If this retirement calculator gets a good response, we’ll work on bringing you one of the best SIP calculators soon. For now, you can check out the apps listed below. Don’t forget to share this retirement calculator with others—your support motivates us to keep creating more useful tools for you, free of charge!

1. What is SIP?

A Systematic Investment Plan (SIP) allows you to invest a fixed amount regularly—monthly or quarterly—into mutual funds. It helps you build wealth gradually and systematically, rather than investing a large lump sum at once.

2. Why SIP is Important in Retirement Planning

SIPs play a vital role in retirement planning as they combine discipline, affordability, and long-term growth. By investing regularly, you make retirement planning easy, stress-free, and achievable for everyone.

3. Key Benefits of SIP for Retirement

• Power of Compounding: The longer you stay invested, the faster your money grows due to compounding.

• Rupee Cost Averaging: SIPs average out your cost by buying more units when prices are low and fewer when prices are high.

• Disciplined Saving: Encourages consistent investing habits for long-term goals.

• Flexibility: Start with as little as ₹500 and increase your investment over time.

• Long-Term Wealth Creation: Regular investments in equity funds can build a substantial retirement corpus.

• Goal-Oriented Approach: Helps align your investments with specific life goals such as retirement, healthcare, or children’s support.

4. How SIP Helps You Stay Financially Secure

SIPs ensure that you have a stable and growing financial base for retirement. By starting early and staying consistent, you reduce financial stress and achieve independence in your golden years.

5. Conclusion

SIP is a simple yet powerful tool for retirement planning. It brings together the benefits of compounding, consistency, and affordability — ensuring a peaceful and financially secure retirement.

👉

Plan Your SIP