EMI Calculator

Available Through Trusted External Tools 🎉

As there is already a superb global EMI and Loan Prepayment Calculator available, we are currently not developing another similar calculator.

Instead, we recommend using the trusted calculators listed below for accurate EMI planning and loan prepayment analysis.

Thank you for your support and for using our tools — we remain committed to building high-quality, useful calculators free for you. 💙

Don’t just plan your EMIs — take control with EMI Part Payments too!

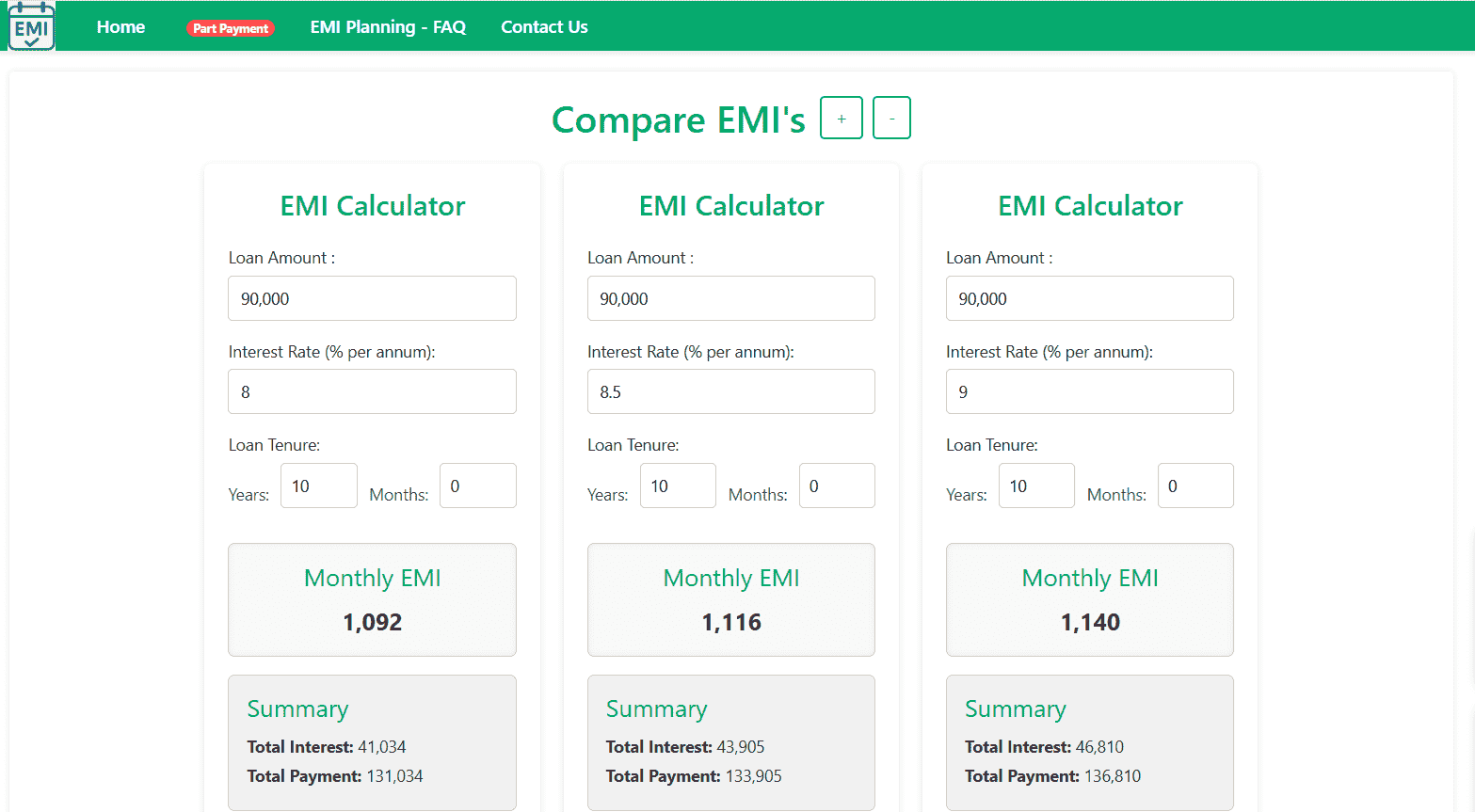

EMI Calculator

One of the best EMI calculator. Here you can compare different EMIs. This will show amotization schedule

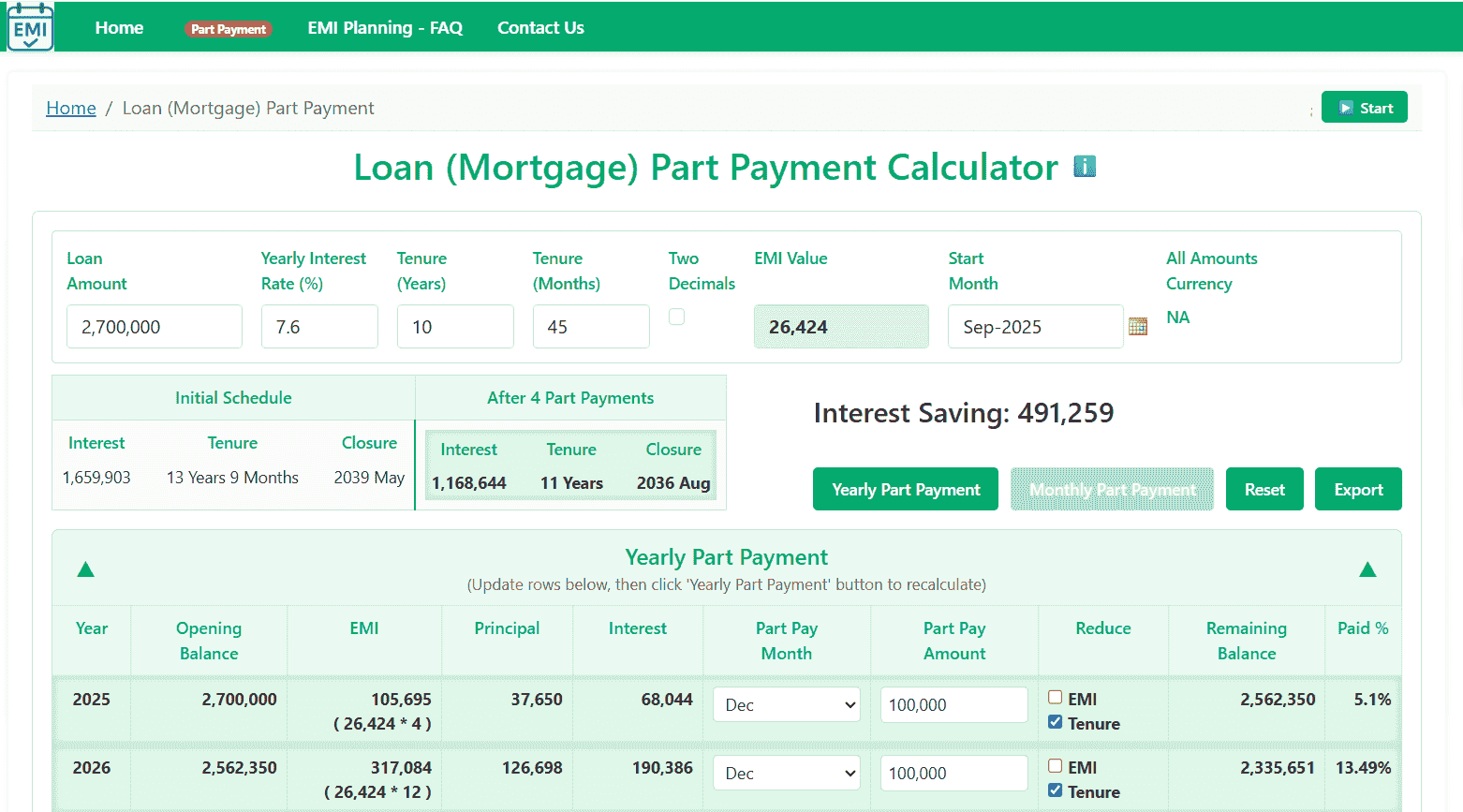

EMI Pre Payment Calculator

One of the best EMI calculator. Here you can compare different EMIs. This will show amotization schedule

1. What is EMI?

An EMI (Equated Monthly Installment) is a fixed monthly payment made by a borrower to repay a loan. It includes both principal and interest.

2. Why EMI Planning Matters

Proper EMI planning helps you avoid over-borrowing, maintain a good credit score, reduce stress, and save on interest costs.

3. Steps for Effective EMI Planning

• Assess income and expenses (keep EMIs within 30–40% of income).

• Choose the right loan tenure.

• Compare interest rates across lenders.

• Prioritize repayment of high-interest loans.

• Maintain an emergency fund of 3–6 months’ EMIs.

• Use prepayments wisely to reduce overall interest.

👉

Plan Your EMI

4. Tools for EMI Planning

Use online EMI calculators, loan management apps, and budgeting tools to plan and track your EMIs effectively.

🔗

EMI Calculator

🔗

Loan Part Payment Calculator

5. Common Mistakes to Avoid

• Borrowing beyond repayment ability.

• Managing too many EMIs at once.

• Ignoring hidden charges and penalties.

• Not preparing for future expenses.

6. Conclusion

Smart EMI planning ensures financial freedom by balancing affordability with long-term savings. With the right strategy, loans can become enablers rather than burdens.

Why EMI (Equated Monthly Installment) Management Require

EMI management is crucial for personal financial health and credit stability. Proper management ensures that loan repayments are handled efficiently without straining your finances. Here’s a detailed explanation:

1. Avoids Default and Penalties

Missing an EMI can lead to late payment fees and penalties.

Continuous default affects your credit score, making it harder to get loans in the future.

2. Helps Maintain a Good Credit Score

Timely EMI payments contribute positively to your CIBIL/credit score.

A higher credit score ensures better interest rates for future loans and easier access to credit.

3. Financial Planning & Budgeting

EMIs are recurring fixed expenses.

Proper management allows you to plan monthly budgets without disrupting other essential expenses.

4. Reduces Interest Burden

Pre-paying EMIs or managing them efficiently can reduce the total interest payable over the loan tenure.

Helps in shortening loan duration if extra payments are possible.

5. Prevents Stress and Financial Mismanagement

Unmanaged EMIs can lead to accumulating debt, missed payments, or even default.

Managing EMIs ensures financial discipline and reduces stress.

6. Helps in Loan Tracking

Keeping track of EMI schedules ensures you know:

• Remaining loan tenure

• Outstanding principal

• Interest paid vs. principal paid

This is useful for planning prepayments or refinancing.

Summary

Good EMI management = part payments of principal + financial discipline + better credit health + lower interest costs.

👉

Try Loan Part Payment Calculator